Amazon set to transform Irish eCommerce: launching Amazon.ie in 2025

In a move set to reshape Ireland's ecommerce landscape and impact the wider European market, Amazon has recently announced plans to launch Amazon.ie in 2025.

Read Article2024-12-13

As the dust settles on Black Friday 2024, the US’s shopping scene has revealed fascinating trends and behaviors that shaped this year’s retail frenzy. From shifting search patterns to category-specific sales booms, here’s a data-driven look at the highlights that dominated the season.

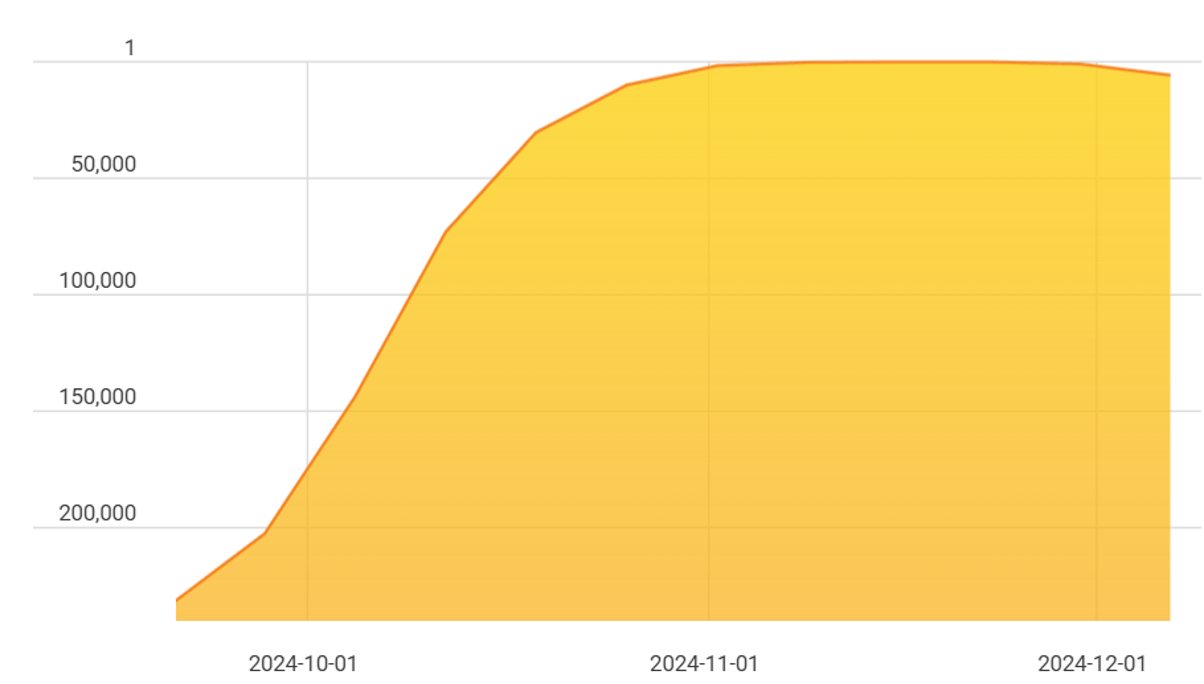

We started to see searches for Black Friday Deals 2024 trending upwards from 28th September. The highest peak for search volume for this term was Week commencing 16th November, ranking as the #36th most searched term on Amazon US.

Amazon's official Black Friday deals started on the 20th of November, US audience peaked early with their deal purchasing.

Dropped to 64th most searched term the day of Black Friday.

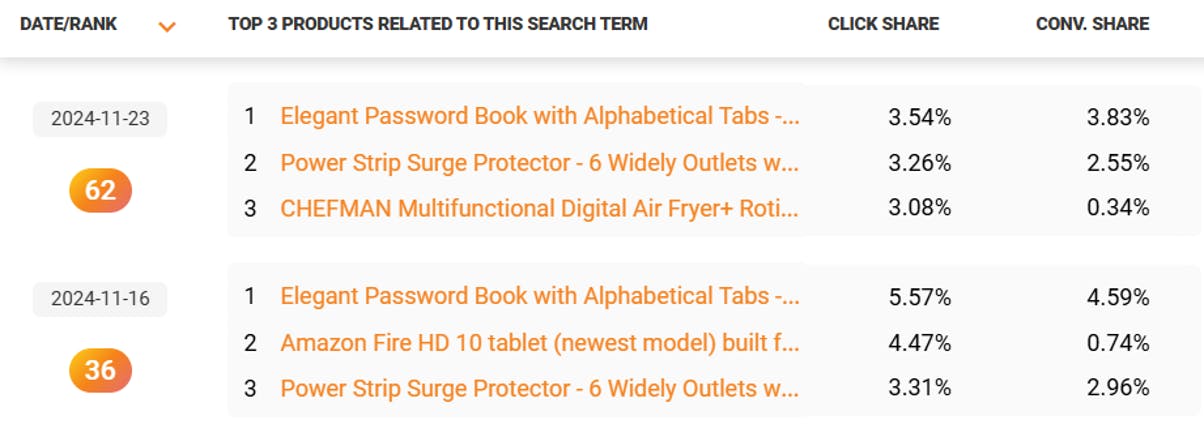

Across the main period of Black Friday, we saw the below products the most clicked and converted for the term ‘Black Friday 2024 deals’.

This includes stationary, air fryer, Amazon Fire Tablet, Electronics (extension & USB cord).

Apple take over the top trends -

Airpods, Ipad & Apple Watch are all among the highest search terms throughout November and the Black Friday period. Closely, followed by Amazon's Kindle.

(based on brands integrated in Ignite)

On average, shoppers enjoyed 34% savings across Amazon US highlighting the strength of promotional campaigns during the season. These insights are based on data from Ignite, reflecting brands running integrated promotions during Black Friday.

The US’s Black Friday 2024 trends paint a clear picture of consumer priorities:

These insights are a valuable roadmap for tailoring strategies to US consumer behaviors as we gear up for the next holiday season.

In a move set to reshape Ireland's ecommerce landscape and impact the wider European market, Amazon has recently announced plans to launch Amazon.ie in 2025.

Read Article

Discover Q1’s key trends on Amazon and learn how to leverage omnichannel strategies to maximize your brand's impact. From understanding the power of Amazon Marketing Cloud to driving full-funnel success, this guide will help you prepare for a successful start to 2025.

Read Article

Black Friday has long been the cornerstone of holiday shopping, but its evolution into a week-long retail extravaganza has shifted the game for brands, especially on platforms like Amazon.

Read Article