2022-10-07

Supply Path Optimisation (SPO) is here to last

1. SPO can tackle the increasing complexity of the programmatic environment

Thomas Allemand, Senior Supply & Adtech Director

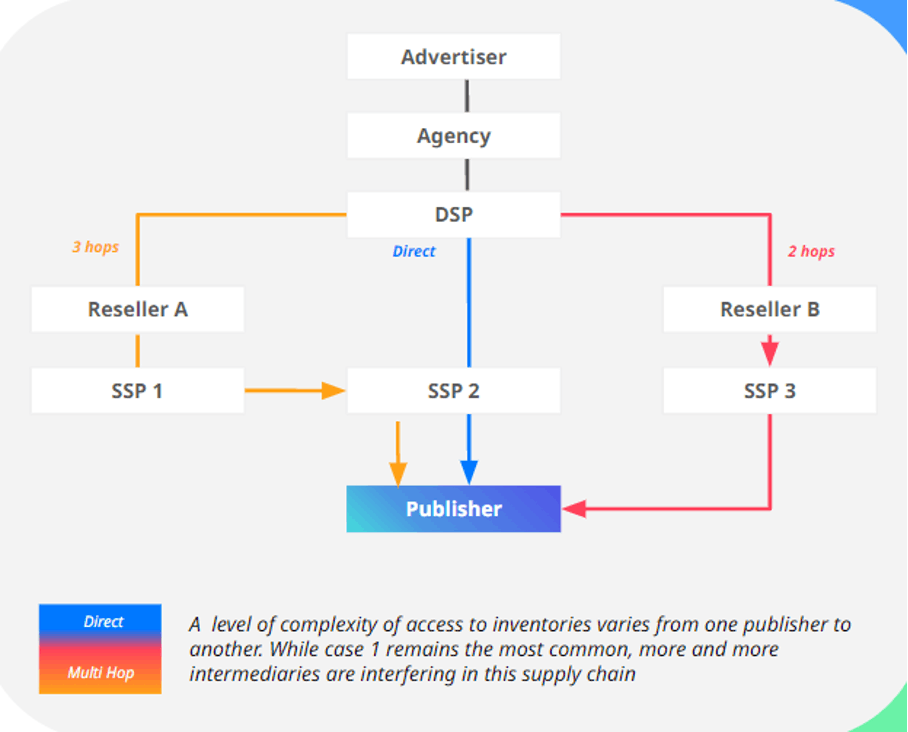

Supply Path Optimisation (SPO), which is centered on an in-depth understanding of programmatic, has become a key issue in programmatic digital marketing due to its complexification. Increasingly sophisticated monetization strategies implemented by publishers have led them to entrust their inventory sales to an ever-growing number of partners. A recent study by MindMedia showed that in January 2022, the leading French publishers worked with an average of 78 SSP partners, exchanges or networks, which represents a 75% increase since 2019.

The extremely high number of inventory supply paths has clouded the actual involvement of different sales technologies in each transaction, leading to potentially significant loss of value. In its May 2020 benchmark study, ISBA revealed that only 51% of the sums invested by advertisers were received by publishers, and that an average of 15% of programmatic investments evaporated within the value chain! This aligns with the findings of programmatic chain optimisation specialist tech company Fenestra, which showed an efficacy gap of over 350% as measured on a range of media indicators, depending on the different inventory supply paths.

As a result of this critical situation, the IAB Tech Lab has suggested a series of technological protocols to increase transparency in the programmatic landscape. Launched in 2019, the Supply Chain Object (SCO) protocol aimed to improve traceability for all sales partners involved in the monetization of each publisher impression. The availability of this data in the Google Ads Data Hub (ADH) data clean room represents an opportunity to use our programmatic and data science expertise, to provide greatly improved transparency for our client programmatic purchases, which is a prerequisite to implement a robust SPO strategy.

2. The preliminary insights highlighted by our audit methodology

Thibault Martin, Senior Data Insights Manager

The availability of inventory supply path data in ADH enabled us to conduct several audits on our media purchasing via DV360. We now have a more detailed and transparent understanding of:

- The interactions between the different players in the programmatic environment;

- The complexity of the multiple paths available for a single domain;

- The development and increasing quality of this data over time.

Since the first semester of 2022, between 80 and 90% of impressions delivered can be analyzed, providing a comprehensive view of all the participants (sellers, resellers, networks) involved in the auctions resulting in impressions. This compares to 25% at the end of 2020 when the beta version enabling us to access this data was launched. This development shows the increasing value in making programmatic purchasing less opaque for key tech players, by implementing the protocols developed by IAB Tech Lab, particularly via ads.txt and sellers.json.

The audit that we have conducted has highlighted the major differences in purchasing behaviors within the supply chain split by exchange. Although almost all purchases were carried out without an intermediary in a few exchanges which gather 75% of our investments, the remaining delivery fluctuates between 40% to 60% of media investments on indirect paths. For some exchanges, almost all deliveries must be conducted via reselling.

We have also seen significant disparities between advertising formats. For the so-called native format, up to 80% of media investments pass through reselling paths, compared to a maximum of 40% to 60% for operators offering video or banner formats. It is interesting to note that standard IAB formats have the longest supply chains, with 10% of investments involving 3 or more intermediaries.

The proliferation of supply paths has a double impact:

- On the seller/publisher side, it will lead to higher costs, hence lower revenue for publishers, as well as reduced revenue traceability.

- On the buyer/advertiser and agency side, it will complexify performance analysis as the host sites may have up to 100 different paths. This is time-consuming to optimize if recommendations are not automated.

More tangibly, we identified 94 different supply paths in a domain that we analyzed, which diluted our investments. We have developed an advanced, proprietary analysis methodology to identify performance-generating paths. If the budget had been allocated solely to these, we would have seen:

- A 34% reduction in viewable eCPM;

- A 35% increase in viewability;

- A 96% reduction in different paths.

More broadly, our research shows that direct paths are very often preferable. However, other reselling paths may also be interesting to consider for buyers as they provide access to an exclusive inventory or data. This means that it is important to consider reselling without preconceived ideas. With the help of a multidimensional analysis, we aimed to identify the most discriminating variables for some media performance indicators, which did not include the number of sellers/ressellers. We must keep in mind that the performance indicators used do not take seller or reseller commission fees into consideration, nor the winrate. These two metrics do not feature in the ADH tables that we use to conduct our analyses.

Despite this, our proprietary analysis methodology confirms that one of the solutions to regain control over the programmatic supply chain is inventory direct path prioritization to target the best sellers for a domain. It will naturally have the tendency to reduce the impact on the number of intermediaries used in purchasing.

Finally, we had the opportunity to work at a very early stage of supply chain data exploitation within Ads Data Hub. This now enables us to develop advanced analyses and to support advertisers who wish to progress and to recover control over their programmatic media supply chain.

3. From insights to decision making: a targeting or an optimisation issue?

Théo Blou, Data Science Solutions Director

Implementation of our analyses is particularly effective as they enable the application of new optimisation strategies to programmatic campaigns delivered via Google DV360 DSP, specifically via custom auction algorithms (or Custom Bidding). How can media buyers use these insights to optimize purchasing costs?

Optimisation of inventory supply pathways via custom algorithms…

The Custom Bidding solution (a custom algorithm where we can activate our proprietary scoring) is currently an amazing opportunity to optimize campaign delivery based on the advertiser’s priorities, whether they are CPA, CPM, visibility or the reduction in the number of intermediaries in the supply path. We put our expertise to work in order to build custom algorithms, aiming to support advertisers in improving distribution quality whilst optimizing costs. This approach has generated a 27% reduction in viewable eCPM for a same-setting campaign.

Automation of this approach is the key to incorporating changes in the programmatic environment, such as available domains, partners to be prioritized, or performance by format. Although very promising, the Custom Bidding feature encounters certain structural barriers associated with its operation.

… which must be developed in parallel with campaign setup redesign

The custom algorithm solution is not restrictive. It does not enable the inclusion or exclusion of certain sellers/resellers or inventory supply paths. To achieve a satisfactory level of control, buyers must have access to these variables when designing campaign setups. The availability of targeting specifically for supply path selection in DV360 would enable purchasers to exert genuine control over how their campaigns are delivered. The existence of features, currently in beta mode, which would allow this in DV360 suggests that an inventory supply path exclusion-based approach will be the norm in the future.

4. What’s next ?

Rafael Lasnier, Senior Programmatic Director

As we have seen above, the major increase in the sophistication of the programmatic landscape over the past few years has led to a loss of transparency and control for publishers and media buyers. In the light of this observation, we are convinced that advanced programmatic value chain optimisation methodologies will play a key role in advertising purchasing the years ahead.

Combined with an in-depth audit upfront, SPO can generate genuine differentiating value for an advertiser and potentially lead to cost savings for all the stakeholders in the programmatic value chain, by focusing media investments on the most valuable players who provide real added value.

Our work on this topic over a number of months has enabled us to shed light on gray areas in the value chain, to identify DV360-compatible optimisation solutions and also to address questions which have not aroused much interest on the market so far:

– Building partnerships with publishers and SSPs for a more comprehensive view of the fees invoiced by each intermediary in the value chain. As this information is still relatively difficult to access on the buyer side, concerted action is needed by publishers and buyers in order to gain an increased understanding of the supply chain. Work is needed on both sides to increase the percentage of investments which actually reach publishers.

– Identification of trusted third parties with the ability to accurately measure the impact of SPO strategies, which should assist in the normalization of the methodologies used.

– Increasingly accurate quantification of the carbon emission impact of the programmatic supply chain in order to identify potential optimisation solutions. This variable could then be included as a factor in our purchasing decisions.