Value-Based Bidding: Start bidding on the customers who impact your bottom line

Discover how Value-Based Bidding (VBB) can revolutionize your advertising approach by targeting customers who truly impact your bottom line.

Read Article2024-04-02

Every marketer and their legal team need to be aware of the changes now in effect that affect the ability to target advertising at audiences within the European Economic Area (EEA). These changes are reshaping the landscape of first-party data activation in 2024 and beyond.

The Digital Markets Act (DMA) seeks to regulate gatekeepers in the digital world, including companies like Google, Meta and Amazon, to ensure fair competition and protect consumers.

At Jellyfish, we’ve created a dedicated microsite that showcases all the adaptations needed for advertisers in a post-DMA world. You'll find indispensable insights and immediate actions required for those utilizing platform products reliant on first-party data. We’ll be updating it regularly as the platforms release critical updates in the ever-evolving digital arena.

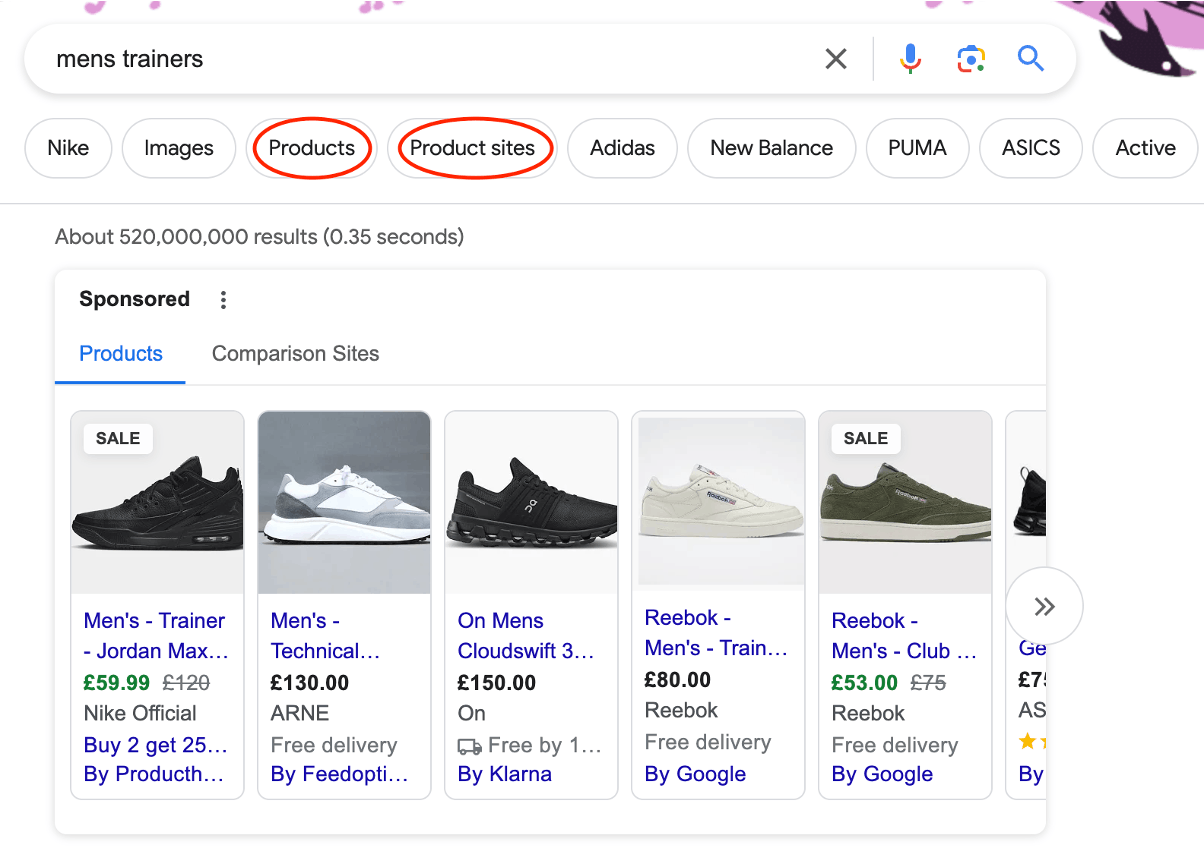

The DMA regulations took effect on March 6, 2024. Consequently, Google has begun implementing several alterations to its Search Engine Results Pages (SERPs), and advertisers/marketers need to be aware of these changes. At Jellyfish, we've observed a noticeable decrease in traffic from SEO and Paid Search text ads for some clients since March, with a drop in the pixel page position for SEO (not ranking). At the same time, there's been an increase in clicks through Shopping ads. It's likely that the greater visual prominence of Product/Shopping tiles in the SERP is causing this shift in traffic.

You’re going to see alterations in the SERPs affecting Comparison Shopping Services (CSSs) Product Description Pages (PDPs). CSSs can now guide traffic to their own PDPs both organically, through Free Product Listings, and via paid placements using Product Listing Ads (PLAs). CSSs will participate in these opportunities under the same conditions as other merchants.

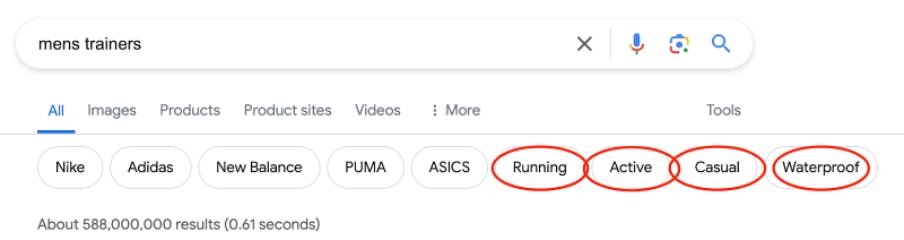

Additionally, you’ll see two new filters in the query shortcut bar:

A Comparison Shopping Service (CSS) a website that collects product offers from online retailers and then sends users to the retailers' websites to make a purchase.

A product description page (PDP) teaches shoppers about your product's features and benefits before they complete their purchase.

Expect to see further modifications to enhance the visual aspect of search:

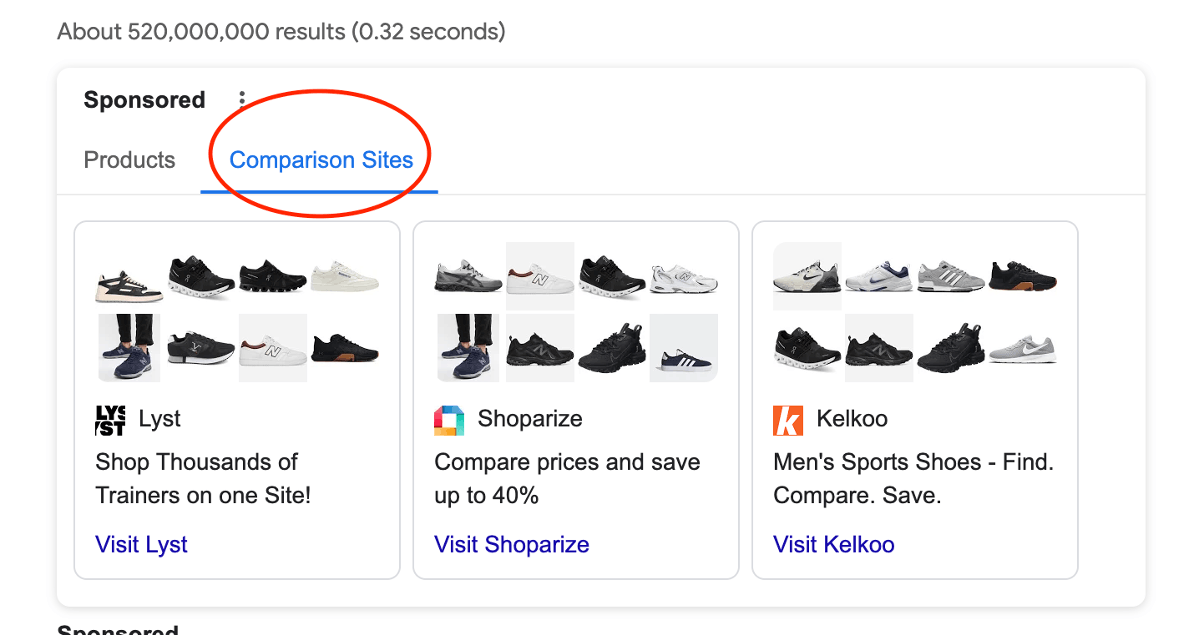

Google has created a special section for comparison sites and direct suppliers, where they can showcase detailed results, including images and star ratings, in one convenient place.

Google is working on adding quick shortcuts at the top of the search page to help users fine-tune their searches, like guiding them straight to comparison sites. This could change how people search, as they might start using these shortcuts to go directly to comparison sites instead of clicking on individual Shopping Ads. As a result, there might be fewer clicks on Shopping Ads, leading to a potential decrease in Click-Through Rates (CTR).

This might make the competition fiercer among advertisers, as they'll have to compete not just with other Shopping Ads, but also with comparison sites and direct suppliers for top spots on the search results page. This could lead to a higher Cost Per Click (CPC).

On the bright side, advertisers running Comparison Shopping Service (CSS) Product Listing Ads (PLAs) alongside their regular PLAs could see some advantages. They could have a stronger presence in the search results, with ads leading users to both their website and the CSS Product Details Page. This dual approach could help them stand out against competitors for certain products.

It's not always the case, and initially, it's not something Google suggests as a solution to this issue. Showing Comparison Shopping Service (CSS) Product Details Pages (PDPs) could actually distract users, steering them away from the advertiser's own product pages. While it might seem like a way to dominate the search results and outshine competitors, there's no guarantee that users will engage or make a purchase when they land on a CSS PDP. Plus, these pages might display listings from different retailers, encouraging users to browse and buy products beyond what's being advertised.

Google is suggesting not to make any change to your current setup, so if you are not using a third-party CSS there’s no need to jump into working with one.

Our experts recommend that in addition to maintaining your current strategy, it's crucial to consistently monitor the performance of your campaigns, including CPCs and any decline in conversion rates.

Advertisers must adopt Consent Mode v2 to transmit two new parameters necessary for maintaining app/web-based remarketing lists in the European Economic Area (EEA). Such efforts will enhance your outcomes and maximize the effectiveness of your marketing investments.

Advertisers must upgrade to the most recent API version and provide two new consent parameters, or confirm that audience lists solely comprise consented users, for manual upload (via in-UI checkbox). This step is essential to ensure the continued utilization of Customer Match lists in the European Economic Area (EEA).

Google Analytics 360 will discontinue support for advertising features (remarketing, conversion export, bidding) for traffic from the European Economic Area (EEA) effective March 6, 2024. Consequently, advertisers will be required to transition to GA4 in order to utilize these features moving forward.

In the beginning, advertisers may notice fluctuations in performance metrics for shopping ads, like Click-Through Rate (CTR), as user behaviors and search result layouts change due to Google's compliance with the DMA regulations.

Advertisers should closely monitor the performance of Shopping (PMax), ensuring all feeds are optimized thoroughly. Additionally, they should allocate sufficient budgets to accommodate any adjustments in strategies, enabling them to adapt effectively to the changing search landscape.

Discover how Value-Based Bidding (VBB) can revolutionize your advertising approach by targeting customers who truly impact your bottom line.

Read Article

In a (not so) surprising turn of events, Google announced that it would not be deprecating third-party cookies as planned. This decision sent ripples through the digital advertising and marketing industries, leaving many advertisers wondering about the implications for their data strategies. Despite this unexpected move, here at Jellyfish, we still believe in the importance of investing in first-party data, and server-side tagging remains as critical as ever.

Read Article

Programmatic advertising often sees 40% of budgets lost in the supply chain due to numerous intermediaries and reselling fees. Discover how our experts address these inefficiencies with advanced Supply Path Optimization (SPO), reducing costs and boosting performance by streamlining ad paths and leveraging detailed data analysis.

Read Article