Amazon set to transform Irish eCommerce: launching Amazon.ie in 2025

In a move set to reshape Ireland's ecommerce landscape and impact the wider European market, Amazon has recently announced plans to launch Amazon.ie in 2025.

Read Article2024-12-13

As the dust settles on Black Friday 2024, the UK’s shopping scene has revealed fascinating trends and behaviors that shaped this year’s retail frenzy. From shifting search patterns to category-specific sales booms, here’s a data-driven look at the highlights that dominated the season.

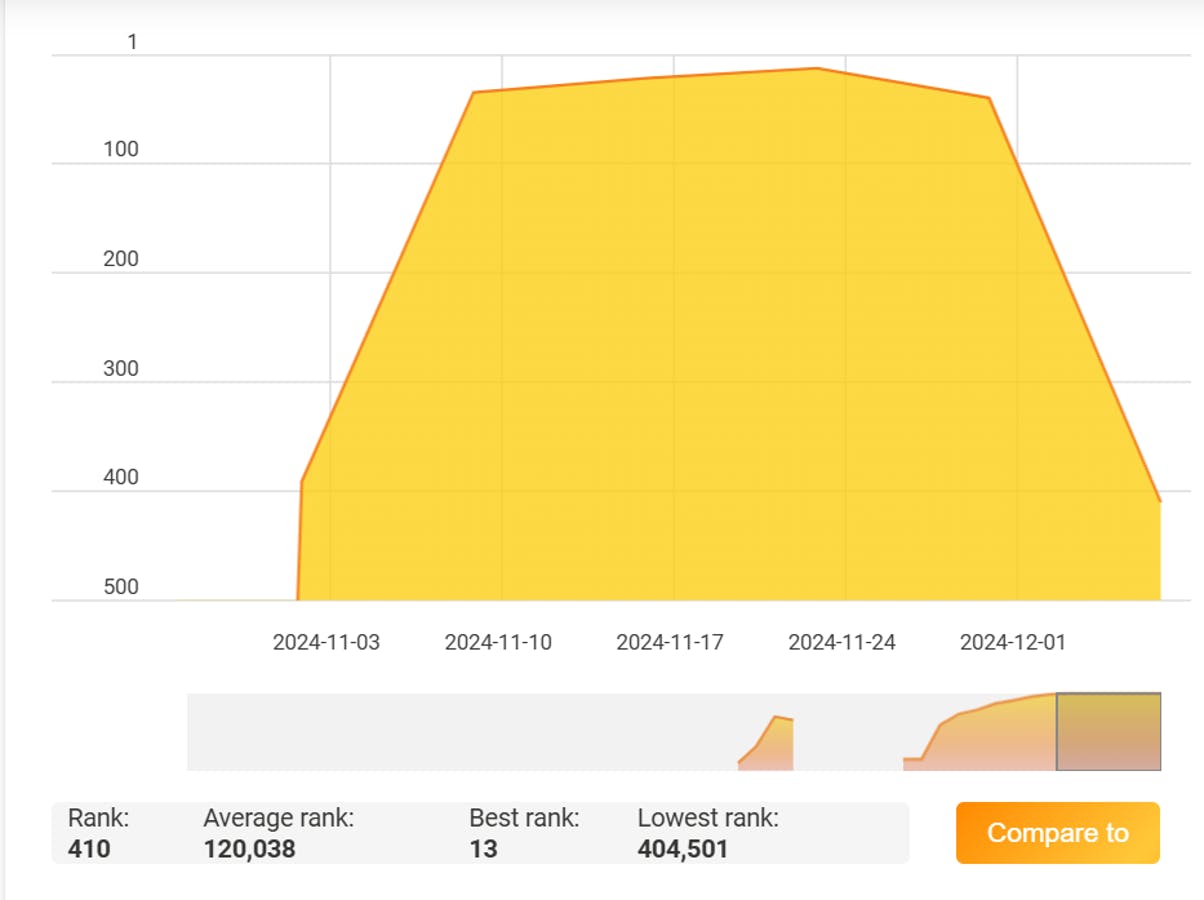

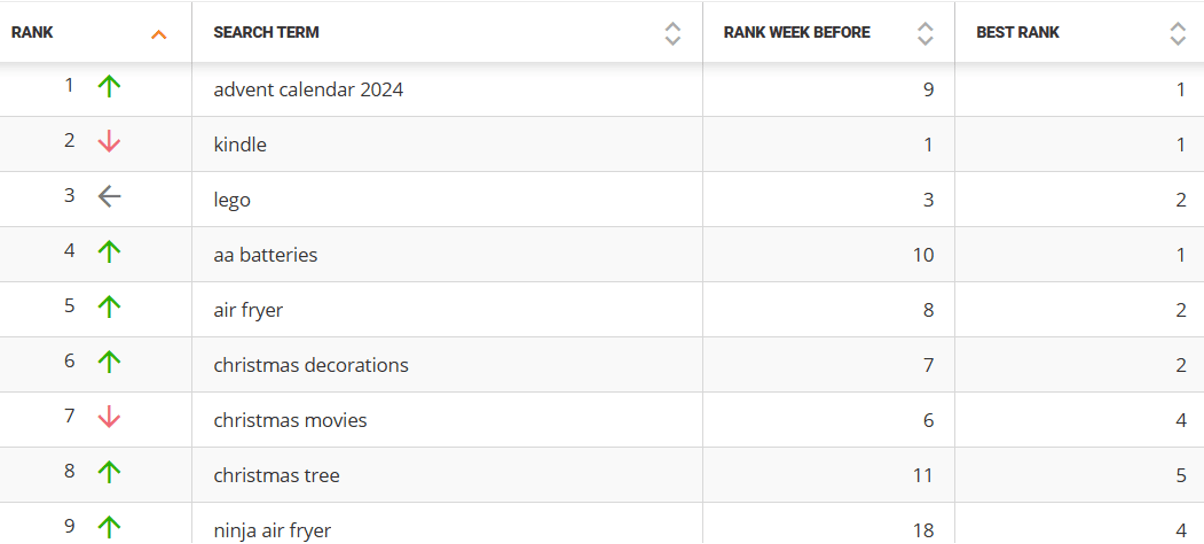

Black Friday Deals 2024 emerged as the 13th most searched term on Amazon UK from November 17th to 23rd, showcasing early interest in festive deals. Surprisingly, by the week of Black Friday (November 24th to 30th), this search term dropped to #40, overtaken by festive favorites like ‘advent calendar 2024’, which claimed the top spot.

See below the search ranks for ‘Black Friday Deals 2024’ between 17th - 23rd November and then the evolution between 24th - 30th Nov.

Despite this decline, staples like Kindle, Lego, and air fryer maintained their positions in the top five most searched items throughout November, reflecting their perennial popularity in the UK market.

The most clicked and converted categories during Black Friday sales were:

One standout trend was the surge in alcohol sales. Over the Black Friday period (November 21st to December 2nd), alcohol brands saw an astonishing 300% sales increase. This contributed to a 38% overall uplift in the grocery category, making it one of the season’s top performers.

On average, UK shoppers enjoyed 34% savings across Amazon UK, highlighting the strength of promotional campaigns during the season. These insights are based on data from Ignite, reflecting brands running integrated promotions during Black Friday.

The UK’s Black Friday 2024 trends paint a clear picture of consumer priorities:

These insights are a valuable roadmap for tailoring strategies to UK consumer behaviors as we gear up for the next holiday season.

In a move set to reshape Ireland's ecommerce landscape and impact the wider European market, Amazon has recently announced plans to launch Amazon.ie in 2025.

Read Article

Discover Q1’s key trends on Amazon and learn how to leverage omnichannel strategies to maximize your brand's impact. From understanding the power of Amazon Marketing Cloud to driving full-funnel success, this guide will help you prepare for a successful start to 2025.

Read Article

Black Friday has long been the cornerstone of holiday shopping, but its evolution into a week-long retail extravaganza has shifted the game for brands, especially on platforms like Amazon.

Read Article