2023-07-31

Prime Day is Over - Get Ready for Prime Day!

Amazon has done it again! US Amazon reports it had the strongest single sale day for Prime Day in the company's history since it launched this event in 2015: Prime Day spending reached nearly $13 Billion in sales, growing about 6% YoY. Things started with a bang on day 1, being the strongest of both days.

The trend is not just in the US. For instance, according to an article in Retail Gazette, the total UK online spend for Amazon Prime Day 2023 reached £1.2bn, a 2.4% rise compared to the total sales from last year’s event. Both were record-breaking days for Amazon UK. The analytics firm forecasts sales across the two-day event will hit £1.2bn, almost double (92%) normal spending levels.

Here at Jellyfish, we were busy across the globe helping our customers reach their goals across the different Amazon marketplaces across North America and Western Europe.

I sat down with the Retail Media and Consulting teams at Jellyfish to understand our learnings from Prime Day 2023. They are experts on Amazon advertising platforms, leveraging media strategies across Sponsored Ads and the Amazon DSP. Jellyfish contributed to growth and success across all clients, and one client in particular, BISSELL, was even featured in this article from Amazon!

Prime Day 2023 for Team BISSELL was the highest-selling event in the company's history. This culmination of belief, commitment, and long-range strategy planning could only be accomplished through a uniquely special relationship built on trust and a drive to win!! A great product at a great deal also helps!!! The relationship we have built with Jellyfish and our blended partnership with Amazon has set us up for success for years to come. This is only the beginning!

Kristen Perry, Director of Digital Sales at BISSELL

We have compiled global learnings, unique and informative on Future Prime Day and Tentpole Events

Day One: Same but not quite…

The first day is historically the busiest across the globe. With our previous expertise, we knew we needed to constantly monitor all our ad campaigns to ensure they wouldn’t run out of budget. Why the early rush? In the US, Prime Day had been advertised heavily in the lead-up, and most deal ASINs had badged before the event, letting consumers know that the product they had their eye on would be part of the sale. Additionally, we focused on executing robust lead-in strategies in the weeks before the event with upper-funnel tactics across campaign types to build momentum.

Despite the early rush, we saw peak performance in most cases later in the day, from afternoon through evening. We saw efficiencies and uptakes in conversions boosting actual sales and driving better return on advertising spend - ROAS. Ensuring that budgets are uncapped during peak purchase times made for a successful first day.

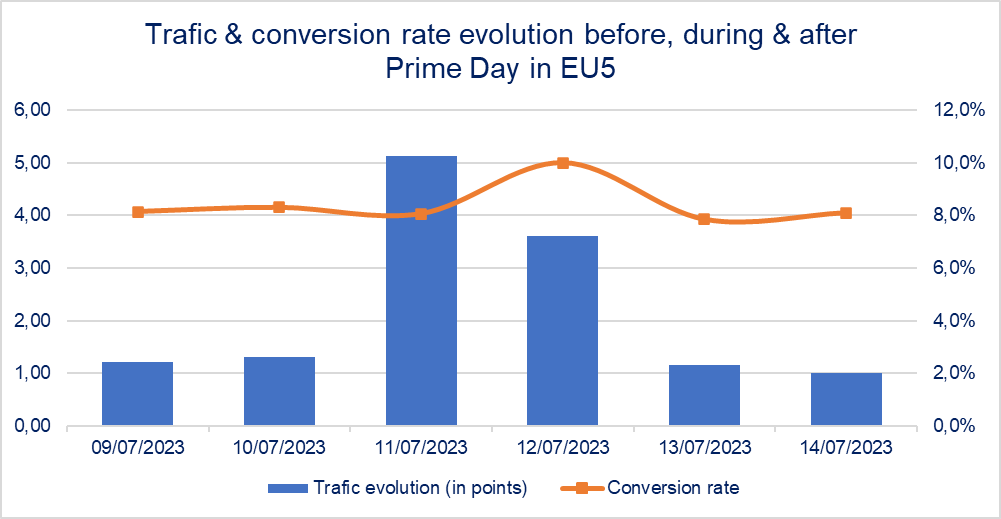

In Europe, traffic significantly increased, multiplied by 4, between the day before Prime Day and the first day of the event. During this period, the conversion rate remained stable, showing a day of high traffic and strong intentionality among clients. On average, Jellyfish observed a substantial +45% increase in the average sales price, suggesting that prospects were targeting more expensive products with a more significant discount.

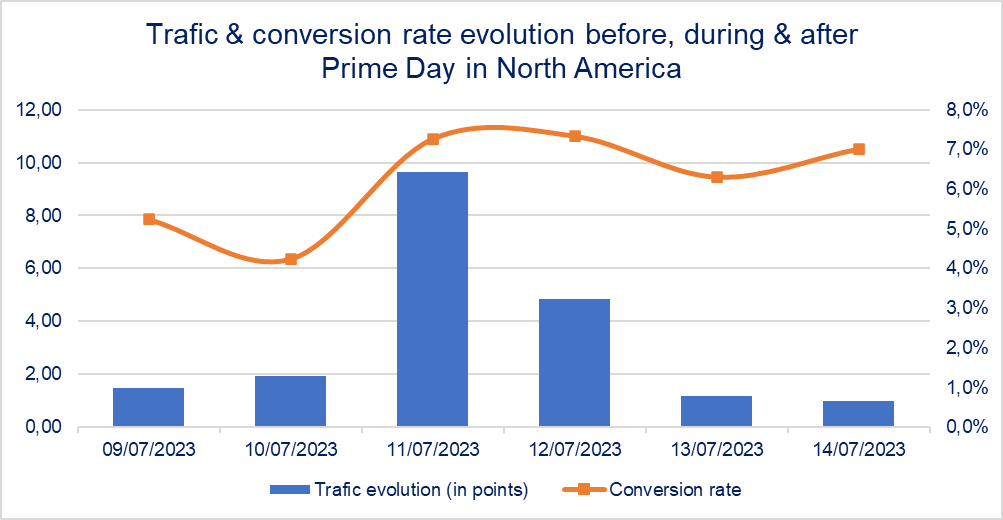

In North America, we witnessed an even more substantial surge in traffic: 8 times between the day before Prime Day and the first day of the event. Visitors' intent also showed a significant increase, with the conversion rate gaining three percentage points and the average sales price doubling before and during the event.

Day 1 was all about efficiency. Looking at ad conversion and conversions generally, the day was solid versus the second. A combination of Product deal badging and investing in the proper Demand Side Platform, and DSP budgets, was the approach to drive excitement and attention on Day 1. People knew what they wanted and went for it on the first day.

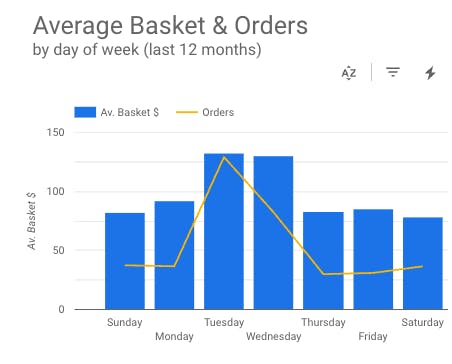

In North America, Day 1 was about snagging the best deal for high-value products. On Day 1, the Avg Sales Price was higher than on Day 2. We see a trend in high-price items featured on Prime Day with deals/discounts.

The graph below shows an example of peak orders and avg basket size on Amazon.com.

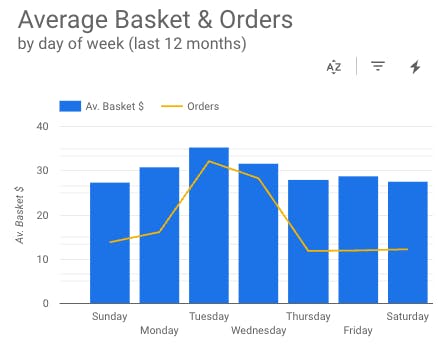

We saw similar trends but smaller ASPs across Europe

Day Two: New Customers

Our data indicate that Day 2 conversions were lower than on Day 1, meaning that the original intent on Day 1 needed to be more prominent, with more people browsing for deals.

Average sales prices were also lower, indicating people were focusing more on last-minute deals or items that were initially badged or added to the cart.

On the second day, we started differently, seeing an uptake in CPCs. The landscape was more competitive but provided an excellent opportunity to capture more new-to-brand customers than on Day 1.

Peak times for buying were later in the day toward the end of the event. We activated remarketing strategies to capture customers browsing early on but had not purchased. Lower funnel tactics were critical drivers on the actual event days.

Throughout North America, we observed a significant decline in traffic, as it was halved between the first day of the event and the second day. However, the stable conversion rate indicates that despite the decrease in traffic, the quality of visitors remained unaffected. Notably, many products offered on deals experienced tremendous success on Day 1, which impacted the overall sales price on Day 2, leading to a decrease of 13 percentage points between the two days.

In Europe, on the second day, we observed an increase in the conversion rate, indicating that prospects were saving products for later conversion. However, traffic decreased by 20% compared to the previous day, which correlates with the decrease in the average sales price on the second day.

What we learned so far

- Overall, we observed higher traffic in all regions before Prime Day than after, emphasizing the importance of being present and visible before peak events, using media and dedicated content.

- Sales attributions are happening, but these are early indicators that building the right momentum to hit the ground running is critical, and finding the right efficiencies to capture new audiences quickly follows suit. More than ever, strategies must cover the marketing funnel through lead-in, event, and lead-out.

- Understanding the contributions between Search and DSP investment are critical to inform the upcoming events post the Summer. At Jellyfish, we help brands do this by leveraging the Amazon Marketing Cloud and analyzing search and display overlaps, multi-touch attribution and display frequency.

What happens next…

Prime Day might be over, but opportunities remain.

More than ever, clients are embracing promotions, primarily due to increased inventory and the need to secure revenue growth in a less dynamic economy. Some discounts are nearly 35% off, and brands have extended the deal for upwards of two weeks post-Prime to continue to drive sales during the lead-out period.

Are the trends we saw today here to stay? There is no magic ball to say this, but we have significant indicators and signals that captivate the customers with deals, and the right DSP strategies pay off in the lower funnel Search investments. Having the right product for the events is critical to avoiding media inefficiencies… arguably, the essential insight comes from measuring the right level of assets and when.

At Jellyfish, we help advertisers across all fronts, from the proper product selection to the right retail media strategy to measurement & insights through extensive work on the Amazon Marketing Cloud.

We are now measuring the impact for our clients and setting the foundation for the next round of a [potential] Prime Day later in the year and the Q4 activity for Black Friday, Cyber Monday, and the gifting season.