What implications does this hold for advertisers?

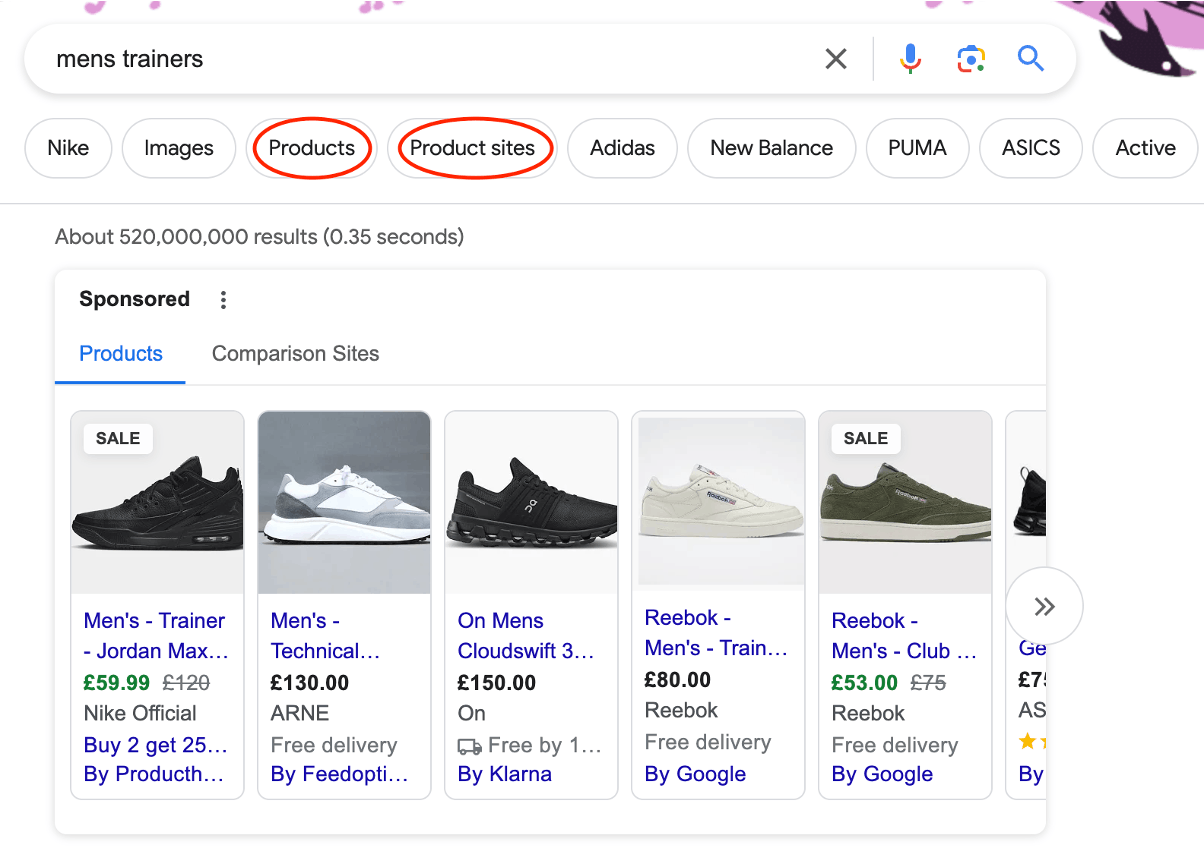

This might make the competition fiercer among advertisers, as they'll have to compete not just with other Shopping Ads, but also with comparison sites and direct suppliers for top spots on the search results page. This could lead to a higher Cost Per Click (CPC).

On the bright side, advertisers running Comparison Shopping Service (CSS) Product Listing Ads (PLAs) alongside their regular PLAs could see some advantages. They could have a stronger presence in the search results, with ads leading users to both their website and the CSS Product Details Page. This dual approach could help them stand out against competitors for certain products.

Is partnering with a third-party CSS the new standard?

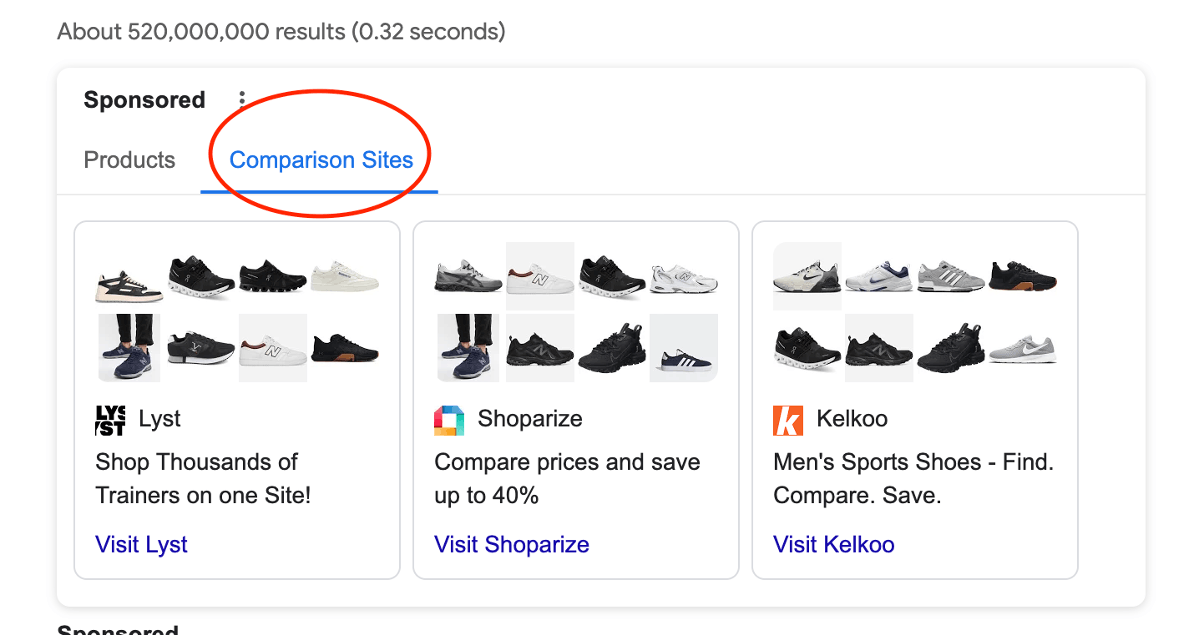

It's not always the case, and initially, it's not something Google suggests as a solution to this issue. Showing Comparison Shopping Service (CSS) Product Details Pages (PDPs) could actually distract users, steering them away from the advertiser's own product pages. While it might seem like a way to dominate the search results and outshine competitors, there's no guarantee that users will engage or make a purchase when they land on a CSS PDP. Plus, these pages might display listings from different retailers, encouraging users to browse and buy products beyond what's being advertised.

Google Recommendations

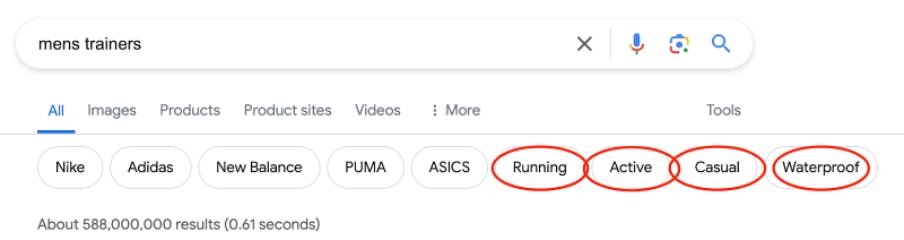

Google is suggesting not to make any change to your current setup, so if you are not using a third-party CSS there’s no need to jump into working with one.

Our experts recommend that in addition to maintaining your current strategy, it's crucial to consistently monitor the performance of your campaigns, including CPCs and any decline in conversion rates.